PPT – FBT update for Local Government Presented by: Stephen Bray Australian Taxation Office PowerPoint presentation | free to view - id: 13b51e-YWRjM

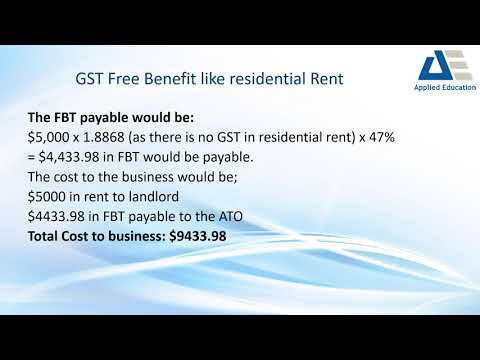

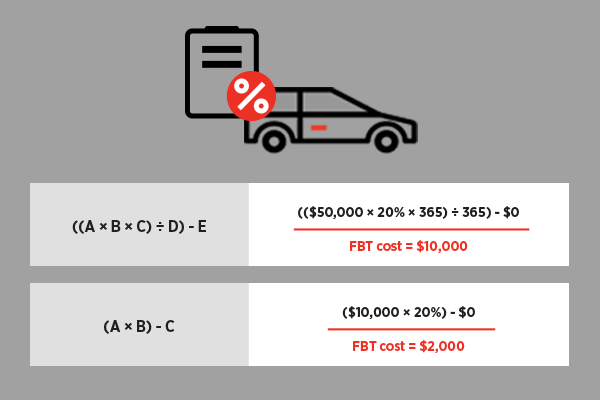

What is Fringe Benefits Tax (FBT) and how is FBT calculated? | The whole purpose of Fringe Benefits Tax legislation is for the government (ATO) to receive the tax that would have